Nvidia surprised the industry by reporting a huge growth in sales of AI hardware, including optical interconnects, in April-May 2023. Google increased its plans for investments in AI Clusters soon after that, and other Cloud companies followed by the end of last year. Chinese companies accelerated their AI investments in early 2024. The race for AI supremacy is in full swing: China vs. the US; Google vs. Microsoft; OpenAI vs. xAI, along with numerous other challengers.

A majority of the projects will fail, but some will succeed, transforming many industries over the next few decades. The optical communications industry is one of a few impacted by AI immediately. We are “selling shovels to the gold miners”.

Sales of 400G and 800G Ethernet transceivers continue to exceed our expectations as the leading suppliers add capacity and numerous others are starting to offer 100G per lane products. We increased our forecast for 2024 and expectations for 2025 are sky high.

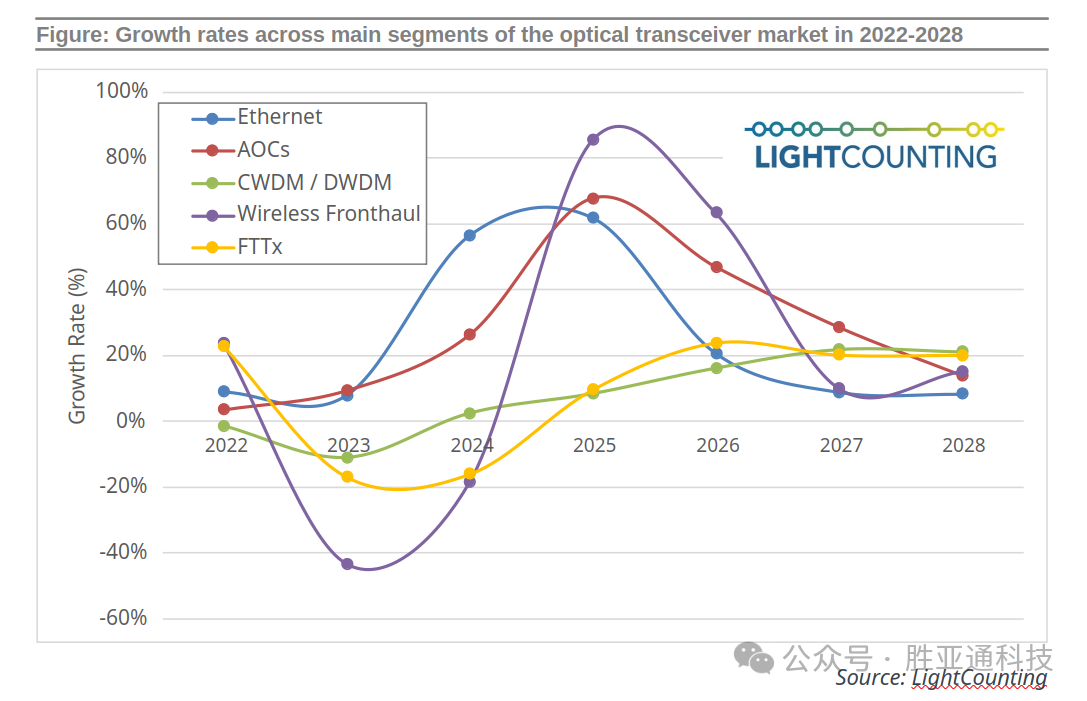

As illustrated in the figure below, sales of Ethernet transceivers are on track to grow by close to 60% in 2024. We are expecting the same growth for next year, but this forecast may prove to be conservative. We also increased our forecast for AOCs and the wireless fronthaul market segment.

Our forecast shows moderation in demand for Ethernet transceivers in 2026-2028, conforming to the historical cyclicality of this market. Many experts argue that this time will be different. History may not repeat itself but it usually rimes. We expect that some return to sanity will be needed in 2026 and it will be overdue by 2028. Whether this will be a soft landing or a crash is anybody’s guess, but the current growth rate can not be sustained forever.

We see a few signs of concern in the market already. Shortages of transceivers and all the components used in them are percolating through the supply chain. There is no doubt that many customers are double ordering to ensure supply continuity. The majority of suppliers are fully booked for the next 12 months. This situation rarely ends well. Even a minor drop in demand can trigger a domino effect, similar to the one observed just two years ago. Many component suppliers must remember how their shipments dropped from huge quantities to zero in a few weeks in the fall of 2022.

Yes, this time is different. Back in 2022, Mark Zuckerberg was among a few leaders excited about the future. His dream for a Metaverse was put on hold just as ChatGPT was unveiled. The rest is history. Yet, we are still very early in the AI race. There will be many barriers to overcome.

Delays in shipments of new chips or in the introduction of new products and services will be hard to avoid. Nvidia’s Blackwell GPUs and Broadcom’s T6 switch ASIC are the two most recent examples. Some of these may rock the market more than others. A few minor hiccups will be easier for suppliers to mitigate than a single crash, but both scenarios are equally possible. There is also a non-zero chance for a steady uninterrupted growth over the next 10 years, but this would be the first such example in the history of our industry and probably in the history of all the other industries as well.

Another lesson from history is that the future will surprise even the most enthusiastic among us. It may take a decade or two for AI to truly change our world, but there is little doubt that it will. Optical connectivity will be part of the new world, including many solutions we can imagine now and a few completely new ones as well.